In the rapidly growing and evolving cannabis industry, dispensaries have become essential hubs for the distribution of both medical and recreational marijuana products. As this industry expands, so does the need for a dedicated and well-compensated workforce to run these establishments efficiently. Dispensaries, like any other business, must have a structured system for paying their employees. So, how exactly do dispensaries pay their staff, and what are the considerations unique to this industry?

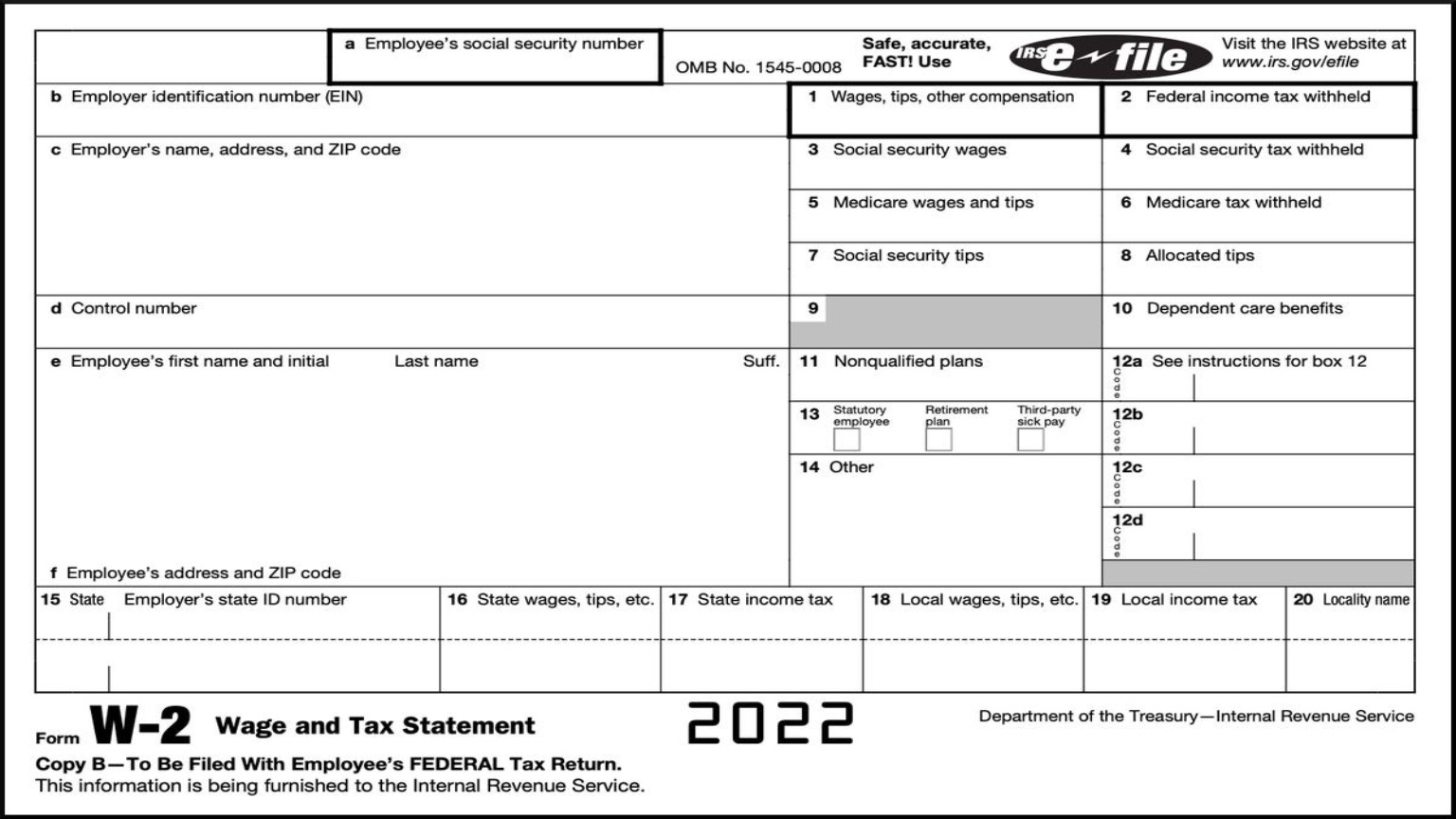

W2 Forms

W2 forms are a crucial aspect of employee compensation in dispensaries, just as they are in any other business. Dispensaries, like all employers, are required to provide W2 forms to their employees by the end of January each year. These forms summarize an employee’s earnings and tax withholdings for the previous year. Employees use W2 forms when filing their income taxes. For dispensary employees, W2 forms serve as an essential tool for reporting income from a federally illegal industry to the Internal Revenue Service (IRS). Despite the federal prohibition of marijuana, the IRS requires cannabis businesses to adhere to tax regulations and report their income. This includes reporting employee wages, which are detailed on the W2 forms. For more information on W2 forms, check thepaystubs.com/w2-form-generator.

Payroll Methods in Dispensaries

Dispensaries often handle significant amounts of cash due to federal banking regulations that limit access to traditional banking services. As a result, some employees may receive their wages in cash. However, this practice can be risky, as it requires strict cash handling and security protocols to prevent theft and maintain accurate records.

Many dispensaries have established relationships with banks or credit unions that are willing to provide financial services to cannabis businesses. With these banking partnerships, dispensaries can offer direct deposit to their employees, a more secure and convenient method of payment.

Another option is the use of payroll cards, which are preloaded with an employee’s earnings and can be used like debit cards. This method can be convenient for employees who may not have traditional bank accounts.

Pay Structures in Dispensaries

Dispensary employees typically receive compensation based on their job roles and responsibilities. Here are some common pay structures within the industry:

Hourly Wages: Many entry-level positions in dispensaries, such as budtenders and receptionists, are paid hourly. The hourly rate can vary significantly depending on factors like location, experience, and job complexity.

Salary: Dispensary managers, supervisors, and other higher-ranking employees may receive a fixed annual salary. Salaries in the cannabis industry can be competitive, especially for those with experience and expertise.

Commission: Some dispensaries incentivize their sales staff, like budtenders, by offering commission-based pay. This means employees earn a percentage of the sales they generate, encouraging them to upsell and provide excellent customer service.

In summary, how dispensaries pay their employees is influenced by the unique challenges and regulations of the cannabis industry. Payroll methods can range from cash payments to more traditional options like direct deposit or payroll cards, depending on the dispensary’s financial situation. Pay structures vary based on job roles and responsibilities, with hourly wages, salaries, and commission-based pay being common. Regardless of the payment method or structure, dispensaries must adhere to tax regulations and provide employees with W2 forms to ensure compliance with federal and state tax laws. As the cannabis industry continues to evolve, so too will the ways in which dispensaries compensate their employees, making it an important aspect of the overall growth and sustainability of this emerging market.